MAGNA Releases June 2024 Global Advertising Forecast, Raises Growth Expectations

IPG Mediabrands’ leading global media investment brand and think tank, MAGNA, has released its June 2024 Global Advertising Forecast report, analysing and predicting advertising revenue and growth across 70 global markets.

Source: https://www.digitaling.com/articles/1227225.html

Top 10 Key Points: Higher than Expected Ad Spend in the First Half

- The summer edition of MAGNA’s Global Advertising Forecast projects global media advertising revenue to reach $927 billion in 2024, a 10% increase.

- MAGNA has revised its 2024 ad revenue growth forecast upwards due to stronger than expected Q1 performance (12% growth) and improved economic outlook (3.2% global GDP growth, 5.2% in Asia-Pacific).

- Traditional media (TMO) ad revenue is expected to grow to $272 billion, a 3% increase, significantly better than the 4% decline in 2023.

- Growth in traditional media ad sales is driven by record-setting cyclical events and a 11% increase in nonlinear ad sales (streaming ads up 18%), now comprising a quarter of traditional media ad revenue.

- Pure digital media (DPP) ad sales will grow 13%, reaching $655 billion.

- Intensifying e-commerce competition, the rise of retail media networks (reaching $146 billion this year), and improved monetisation of short videos and social media will drive digital ad sales growth.

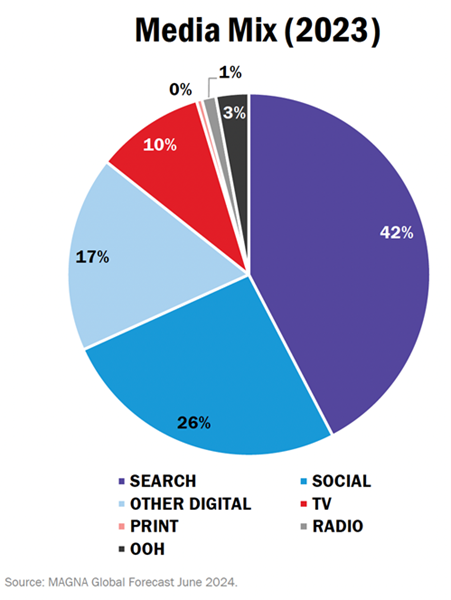

- Keyword search remains the largest digital ad format, projected to grow 12% to $330 billion. Social media, led by Meta and TikTok, is expected to grow 18% to $212 billion, with short video platforms like YouTube and Twitch growing 14% to $78 billion.

- The most dynamic ad markets in 2024 include Spain (14% growth), India and the UK (both 12%), and France and the US (both 11%). Germany and China are experiencing economic challenges, with ad spend growth (both 8%) falling below the average.

- The Asia-Pacific ad market will grow 8.5% to $289 billion, with traditional media ad sales up 0.8% to $68 billion and pure digital media ad revenue up 11.1% to $220 billion.

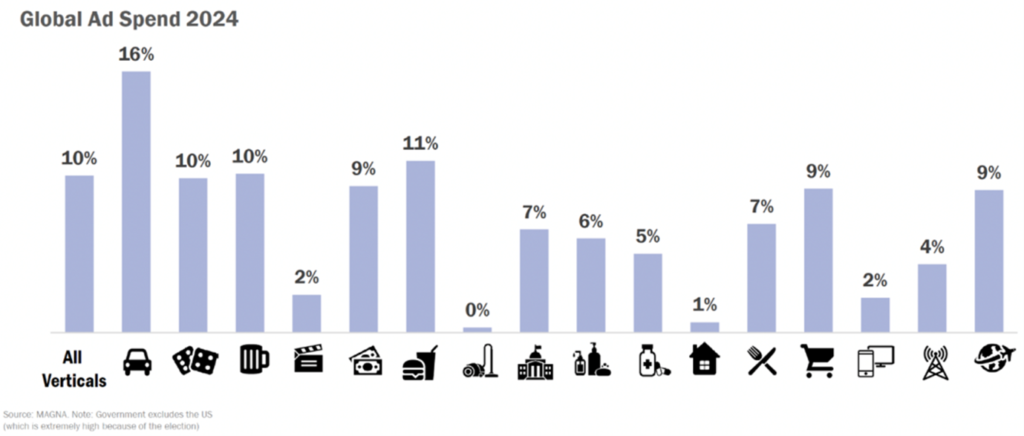

- Automotive and FMCG brands will be the fastest-growing verticals in ad spend, with financial sector ad spend also rising, and government ad spend increasing in election years.

MAGNA’s Executive Vice President of Global Market Research and the report’s author, Vincent Létang, stated: “After analysing media companies’ financial reports, it’s clear that Q1 2024 ad revenues exceeded expectations. With improved macroeconomic prospects, we’ve raised our global ad growth forecast for the year from 7.2% (December 2023) to 10%. So far, all media types have outperformed expectations, including traditional media, with TV and premium long-form video doing particularly well. Almost all streaming platforms, including Prime Video, have launched ad-supported versions in more markets, driving a 16% increase in nonlinear TV ad sales and a 4% increase in total TV ad sales.

Vincent Létang Tweet

The summer edition of MAGNA’s Global Advertising Forecast anticipates global media net ad revenue (NAR) to reach $927 billion in 2024, up 10.0% from 2023’s 6.4% growth rate. Excluding cyclical event impacts, both 2023 and 2024 have seen moderate yet substantial growth, with non-cyclical ad revenue up 7.5% in 2023 and projected to rise 8.7% in 2024.

2024 will feature numerous record-setting cyclical events, including four major sports events (Paris Olympics, 2024 UEFA Euro, America’s Cup hosted by the US, and ICC T20 Cricket World Cup co-hosted by the US and West Indies) and elections in five major markets (Mexico, India, US, France, and the UK). The first three elections allow for political ads, which will boost ad sales. Overall, these cyclical events will contribute an additional 1.3% to global ad revenue, with TV ad revenue up 5% and digital media ad revenue up 0.5%, with the US alone contributing nearly 2% growth.

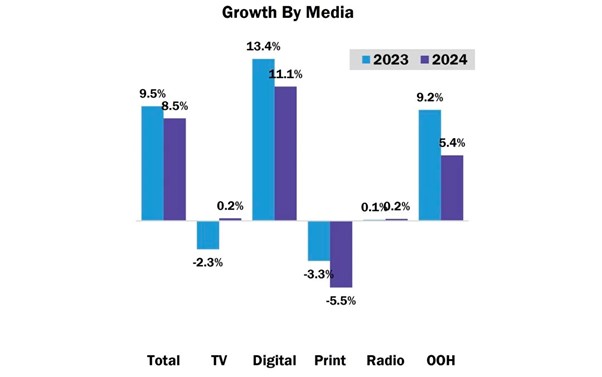

Media: Double-Digit Growth for Digital Media Ads

Due to the base effect (extremely weak Q1 2023 ad market), MAGNA has consistently expected strong year-on-year growth for the Q1 2024 ad market. After analysing Q1 media company financial reports, we find that Q1 2024 ad performance exceeded expectations, with major markets averaging 12% year-on-year growth, led by Spain (17%) and France and Germany (15% each). With higher year-on-year comparables in H2, quarterly growth is expected to slow. However, a strong start to 2024, combined with a more optimistic economic outlook, has led us to raise full-year 2024 expectations across nearly all monitored markets, with global growth now forecast at 10%, up from December’s 6.4%. According to the latest forecast, full-year traditional media ad revenue will grow 3%, not the previously forecast 2%, while pure digital media ad sales will grow 13%, up from the previous 9.4%.

Traditional media (TMO) includes TV, audio, publishing, outdoor, and cinema media. In 2024, global traditional media ad revenue will grow 3% to $272 billion.

Nonlinear ad sales (ad-supported streaming, digital audio, digital publisher ads) now account for 25% of traditional media ad revenue, driving traditional media growth despite stagnating linear ad sales. 2024 will see the takeoff of ad-supported streaming, with traditional TV companies (e.g., Disney+, Max, ITV Hub, Joyn, TF1+) and pure streaming companies (Netflix, Amazon) generating at least $18 billion (16% growth) in 2024. By mid-2024, Amazon will have launched ad-supported Prime Video versions in major markets (US, Canada, Mexico, France, Germany, Italy, Spain, UK), defaulting all users to ad-supported versions. MAGNA expects most users to remain on this platform without upgrading to pricier ad-free versions. Other streaming platforms are also launching ad-supported versions in more markets (e.g., Max in Latin America in February 2024), with rising ad-free platform prices making ad-supported versions more attractive to viewers.

Cross-platform TV remains the largest traditional media segment, with total ad sales projected to reach $162 billion (4% growth) in 2024. Cyclical events and ad-supported streaming growth will benefit cross-platform TV companies. Print media ad sales will remain weak (down 3% to $44 billion), but radio ad sales will grow 2% to $29 billion.

Outdoor advertising, having returned to pre-pandemic levels in 2023, will continue strong organic growth (7% increase to $35 billion), driven by new screen units and increased programmatic ad spend, leading to a 12% growth in digital outdoor ads, which now account for nearly 40% of global outdoor ad sales.

Pure digital media (DPP) includes search/e-commerce, social, short video, static banner, and digital audio ads. In 2024, pure digital media sales will reach $655 billion, a 13% increase from 2023, accounting for 71% of total ad sales. Multiple organic factors are driving digital ad growth, including the rise of e-commerce, retail media networks providing needed consumer data for the programmatic ecosystem, digital ad penetration in emerging markets, and increased monetisation efficiency of niche short videos on social and video apps.

Keyword search remains the largest digital ad format, expected to surpass $330 billion in 2024, driven by retail search ads (e.g., Amazon and product listing ads, growing 14% to $126 billion) and core search ads (e.g., Google, Bing, Baidu, growing 11% to $204 billion). Social media ad sales, led by Meta and TikTok, will grow 17.5% to $212 billion, while pure short video platform ad revenue (YouTube, Twitch) will grow 14% to $78 billion.

Markets: India and Spain Most Dynamic

Economic outlook is the main driver behind ad spend decisions, and economic activity has been stronger than previously expected. In April, the International Monetary Fund (IMF) raised its 2024 global GDP growth forecast (from 2.9% to 3.2%), along with growth forecasts for the US (from 1.5% to 2.7%), China, India, and Brazil. Meanwhile, the IMF lowered GDP growth forecasts for France and Germany, but these markets will host major sports events this year, boosting marketing and ad activity. Inflation has slowed globally, with most major markets expected to see inflation rates around +2% to +3%, still above long-term targets but not enough to impact FMCG brand sales and marketing.

The most dynamic ad markets in 2024 include Spain (14% growth), India and the UK (both 12%), France and the US (both 11%). Germany and China are facing economic challenges, with ad spend growth (both 8%) below average.

US Media Advertising Revenue to Grow by 10.7%, Reaching $374 Billion. The United States remains the world’s largest and most concentrated advertising market. In 2024, US advertisers are expected to spend an average of $1100 per consumer, which is eight times the global average ($160), ten times the average in China ($110), and a hundred times the average in India ($10).

Key Advertisers: Automotive and FMCG Brands Shine

The automotive, food, and beverage sectors are anticipated to be the fastest-growing verticals in 2024. The finance/insurance sector is also on the fast track again. With multiple elections set to take place this year, government advertising spending is projected to see explosive growth (elections in India, Mexico, the UK, and the US are expected to contribute over $9 billion in additional ad sales in 2024).

Automotive brands were particularly active in 2023 due to intensified competition in the electric vehicle market and the resolution of supply chain issues from 2021 to 2022, which had affected car sales. Although car sales growth is slowing down in 2024 (with European sales up 7% from January to May, but US sales only up 2%), the increased competition among traditional brands, pure electric vehicle brands, and new Chinese brands, along with major sports events, is expected to boost car marketing and advertising above average levels.

In the high-inflation environment of 2022 and 2023, food and beverage brands were heavily impacted. Faced with rising costs, marketers had to increase retail prices, making them more susceptible to consumer downgrades and retail brand competition. During this period, many food, beverage, and other FMCG brands focused their advertising on retail media rather than traditional media. Now, with commodity costs and consumer price inflation under control, marketers are expected to restore their brand advertising budgets to normal levels, leveraging major sports events for marketing opportunities while reallocating in-store marketing budgets to support e-commerce and increase retail media advertising.

The finance/insurance sector, a highly anticipated vertical, has shown strong performance as it finally overcomes several challenges faced in recent years, including the COVID-19 pandemic, the rise and fall (and rise again) of cryptocurrencies, and the impact of high-interest rates on mortgages, loans, and credit cards.

In the retail sector, marketing spending by traditional brick-and-mortar brands has matured and is now slowing down, while emerging e-commerce brands like Temu and Shein are actively expanding their advertising share. With these opposing trends, retail sector advertising activity is expected to remain stable overall.

MAGNA predicts that advertising growth in several large verticals will be below average. The tech and telecom sectors’ marketing and advertising activities continue to be sluggish due to a focus on profitability over growth, slowing technological innovation. Media/entertainment brands also prioritize bottom-line performance (operating profit). In 2023, Hollywood film production stalled for six months, resulting in fewer new films and shows to advertise in 2024. After the significant rebound in the travel industry from 2021 to 2023 post-COVID, growth is expected to slow this year, leading to a decrease in advertising spending. However, some sub-segments like business travel and cruises are expected to continue expanding their markets in 2024.

Media: Increased Digital Concentration

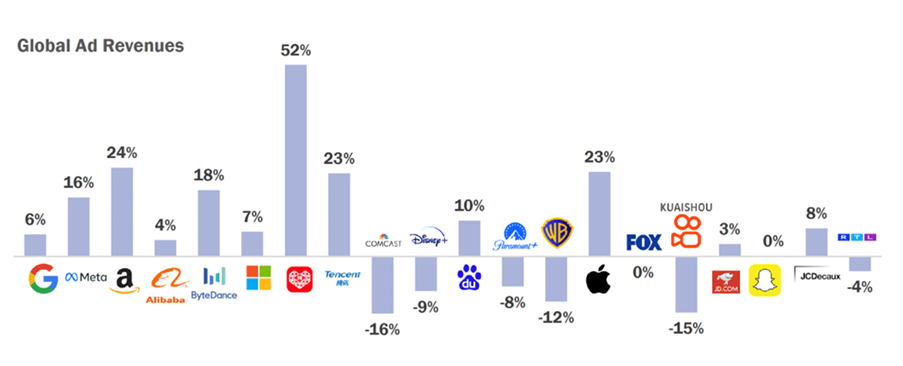

According to financial reports from media companies, MAGNA’s report estimates advertising revenue for these companies. The report shows that global media concentration increased again in 2023. After a stagnation in global ad sales by digital media giants throughout 2022 and the first half of 2023, there was a return to accelerated growth in the second half of 2023. The main reasons for the slowdown from mid-2022 to mid-2023 included the rapid rise of vertical short videos in social and video apps and the initial weakening of ad monetisation by companies like Meta and YouTube. From the third quarter of 2023, these companies improved their monetisation capabilities, achieving strong quarterly growth.

In 2023, organic ad revenue growth for Google, Meta, and Amazon was 6%, 16%, and 24% respectively. Outside China, these three giants captured 60% of the total global ad revenue (417 billion out of 698 billion dollars), up from 57% in 2021-2022. Including China (where these giants have no business), they hold 49% of global ad sales.

Among the world’s top 20 ad suppliers in 2023, Amazon (up 24%), ByteDance/TikTok (up 18%), and Apple (up 23%) saw the most notable ad revenue growth, while most traditional media companies saw global ad sales decline, such as Comcast (down 16%), Disney (down 9%), Warner (down 12%), and RTL (down 4%). JCDecaux was the only leading traditional media company to achieve ad sales growth (3%) in 2023.

In the first quarter of 2024, leading global digital media suppliers reported their strongest growth performances in over two years. MAGNA’s financial report analysis shows that global search ad sales grew by 16% year-on-year, pure video ad sales grew by 21% year-on-year, and social media ad sales grew by 28% year-on-year. As competition intensifies, quarterly growth is bound to slow, but MAGNA expects double-digit growth rates for all major digital ad formats and media suppliers this year.

Asia-Pacific Market: Digital Ad Revenue Drives Growth

In 2024, the Asia-Pacific advertising economy is expected to grow by 8.5% to $289 billion, following a 9.5% increase to $266 billion in 2023. The International Monetary Fund (IMF) predicts a real GDP growth rate of 5.2% for the Asia-Pacific region in 2024, indicating a slight economic slowdown but stable growth. Inflation rates in the Asia-Pacific region continue to decline. While some economies still face price pressures, others are transitioning to deflationary risks. The combination of global deflation and prospects for monetary easing increases the likelihood of a soft economic landing.

The overall growth rate for the Asia-Pacific region will reach 8.5% in 2024, with traditional media growing by 0.8%, totalling $68 billion (24% of the total budget), and pure digital media growing by 11.1% to $220 billion (76% of the total budget). Television advertising budgets are expected to stabilise in 2024, growing by 0.2% after a 2.3% decline in 2023, driven primarily by sports events (notably the Paris Olympics). Typically, the European Cup and other sports events have only a slight impact on the Asia-Pacific market.

Digital ad revenue is the growth driver for the Asia-Pacific region. Search ads remain the leader in digital ad revenue, with search ad spending reaching $103 billion in 2024, accounting for 47% of the digital ad budget. The growth of search ads in the Asia-Pacific region is mainly driven by retail media platforms, especially in China, where retail media giants like Alibaba, JD.com, Pinduoduo, and Meituan drive search ad growth. Traditional search platforms like Google and Baidu are also performing well, pushing core search ads to rapid global development.

Social media ad revenue will continue to grow strongly in 2024. Following a 19% increase to $65 billion in 2023, social media ad revenue in the Asia-Pacific region is expected to grow by 15% to $74 billion in 2024, making up 34% of the digital ad budget. The widespread use of mobile devices underpins the growth of search and social media ads. Smartphones are not only the primary means of internet access for most consumers but in several Asia-Pacific markets, they are often the only means. Many consumers in these markets have bypassed the desktop computer era, entering the digital age solely through smartphones. In China, consumers can use smartphones for shopping, communication, and accessing a range of services, including banking, insurance, and office functions. Consequently, 76% of the Asia-Pacific region’s digital ad revenue comes from mobile devices.

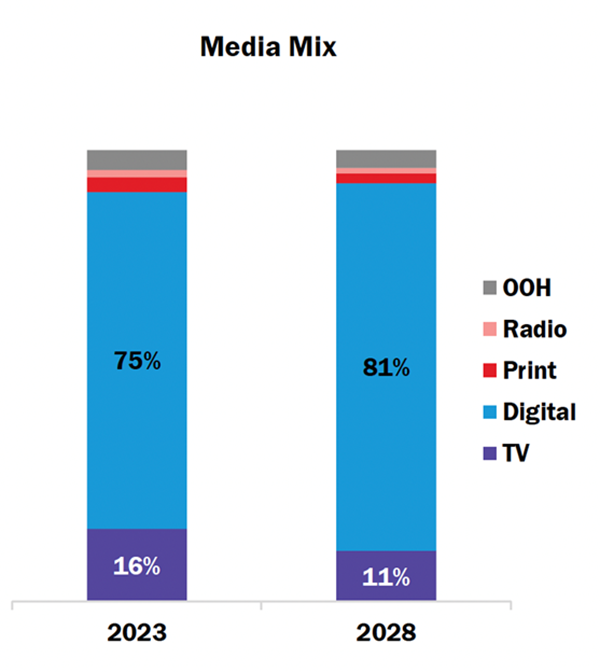

The digital advantage in the Asia-Pacific region supports ad growth and is expected to drive the share of digital ad revenue higher. By 2028, the share of digital ad revenue in the total budget is expected to increase from 76% in 2024 to 81%.

In 2024, Sri Lanka (up 12%), India (up 11.8%), and Japan (up 11.8%) will be the fastest-growing markets in the Asia-Pacific region. Japan is set to achieve strong results again in 2024 following a 5.6% increase in 2023. Several traditional mature markets are also expected to rebound in 2024. The Asia-Pacific region remains dominated by China, which accounts for about half of the region’s total ad revenue. Together with Japan, Australia, India, and South Korea, these five markets account for 87% of the Asia-Pacific region’s total revenue.

By 2028, the proportion of linear ads in total revenue is expected to decrease to 19%, with revenue (US$65 billion) remaining roughly the same as the current amount (US$68 billion). On the other hand, pure digital ads will dominate, accounting for 81% of the total budget, reaching US$286 billion, significantly higher than the 2024 total (US$220 billion). The absolute largest ad formats by 2028 compared to 2024 include search ads (up by US$28 billion) and social media ads (up by US$27 billion).

Leigh Terry, CEO of IPG Mediabrands Asia-Pacific, commented: “The advertising industry in the Asia-Pacific region is expected to continue growing in 2024, with an anticipated increase of 8.5%, reaching $289 billion. This follows a 9.5% growth rate in 2023. Despite a turbulent economic environment, digital advertising remains the primary driver of ad growth, particularly search and social media ads. In the Asia-Pacific region, digital advertising is expected to maintain its dominance, with digital ad revenue projected to account for 81% of the total budget by 2028, up from 76% in 2024. This shift highlights the increasing importance of digital channels in reaching and engaging consumers in the Asia-Pacific region. Sri Lanka, India, and Japan are expected to achieve significant growth in 2024, and mature markets in the region are showing signs of recovery, illuminating a positive outlook for the Asia-Pacific region.”

Leigh Terry Tweet

China: The World’s Second-Largest Advertising Market

China’s economic growth continues to slow, but advertising revenue remains robust, with digital and digital outdoor ads performing particularly well. Despite concerns over AI applications, tightening user privacy protection requirements, and growing demand from advertisers for product synergies, these factors have not hindered the continued growth of digital budgets. As a result, while digital ad growth may slow, it will still lead the Chinese advertising market’s development. Additionally, traditional internet platforms like Baidu and Weibo are losing ad share to emerging commercial platforms. New platforms such as Xiaohongshu (a community commerce platform) and Bilibili (a video sharing platform) are continually enhancing their commercialisation processes.

In 2023, China’s GDP reached $17.3 trillion, solidifying its position as the world’s second-largest economy. With a population of 1.41 billion, China saw its advertising revenue reach an impressive 1 trillion yuan ($144.7 billion). Digital media dominates the advertising landscape, accounting for 86% of the total budget in 2023, up from 54% in 2015. Television ads made up 10% of the 2023 budget, down from 32% in 2015, with print and radio ads occupying small shares and outdoor ads accounting for 3%.

The telecommunications sector leads with $22 billion in revenue, followed by the tech sector ($21.4 billion) and the automotive sector ($17.7 billion). In 2023, 5% of China’s TV ad revenue came from digital ad formats. Additionally, 15% of traditional media’s total revenue also came from digital ad formats. In 2024, the growth rate of digital formats for traditional media is expected to reach 11%.

China’s advertising revenue surged to 1 trillion yuan ($144.7 billion) in 2023, up 12.4% year-on-year, solidifying its status as the world’s second-largest advertising market.

The “Internet Advertising Management Measures,” implemented in May 2023, have driven continuous growth in digital ad revenue. These measures require internet ads to be truthful and legal, in line with the requirements of socialist spiritual civilisation construction. They prohibit online tobacco and prescription drug ads and strictly limit pop-up commercial ads. New restrictions on online live streaming aim to control this rapidly growing ad format. Against this backdrop, digital media experienced strong growth, with ad revenue soaring to 895.4 billion yuan ($124 billion), a year-on-year increase of 14.6%. Search ad revenue surged by 12.3% to 442.7 billion yuan ($61.3 billion), while social media and digital video ads grew by 21.4% and 13.6%, respectively. Mobile ads accounted for 89% of total digital ad revenue.

In 2024, China is set to experience a “sports year,” which is expected to boost ad growth, particularly benefiting leisurewear, health food and drink brands, and travel brands. With the much-anticipated Olympics approaching and the F1 Grand Prix returning to China after five years, widespread social media buzz and discussion are expected. China’s ad revenue is projected to continue growing in 2024, reaching 1.1261 trillion yuan ($156 billion), a steady increase of 7.7%, further consolidating its position as the world’s second-largest advertising market. Digital media revenue is expected to climb to 976.3 billion yuan ($135.2 billion), up 9%. Search and social media ad revenues are forecasted to grow by 8.1% and 11.9%, respectively, while digital video ad revenue is expected to rise by 8.6%. Mobile ads will take centre stage, accounting for 91% of total digital ad revenue.

Looking ahead to 2028, China’s total ad revenue is expected to grow at an annual rate of 4.8%, with digital media ads growing at an annual rate of 5.8%, while traditional media is likely to see a slight decline of 2.5% annually. By 2028, China is expected to maintain its position as the world’s second-largest advertising market.