Global Mobile Game Advertising Trends: A Deep Dive into SOV Rankings and Market Impact in 2024

According to a report by Sensor Tower, in mobile game markets ,light casual games such as puzzles and card games prefer to advertise on platforms like AppLovin, Mintegral, and Meta Audience Network. In contrast, RPGs and strategy games tend to favour YouTube, TikTok, and Meta platforms.

In Q2 of 2024, the share of voice (SOV) for puzzle game ads in the US mobile game market on the AppLovin platform reached 40%, with ‘Royal Match’ and ‘Match Factory!’ being the top advertisers.

Advertising is a crucial strategy for quickly gaining market traction and maintaining popularity in mobile gaming. In 2024, popular games in the US, Japan, and South Korea led in mobile game ad exposure on various platforms.

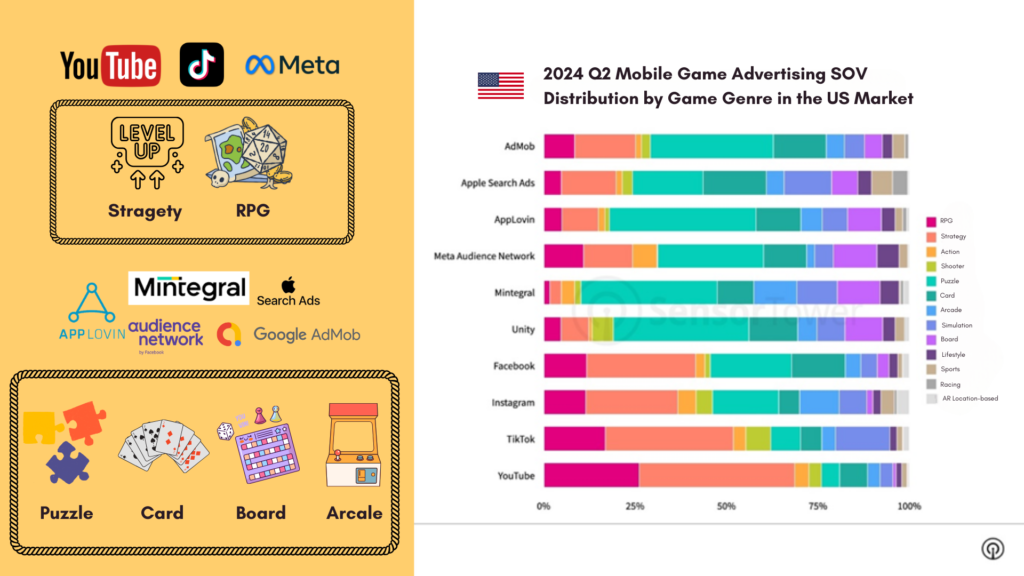

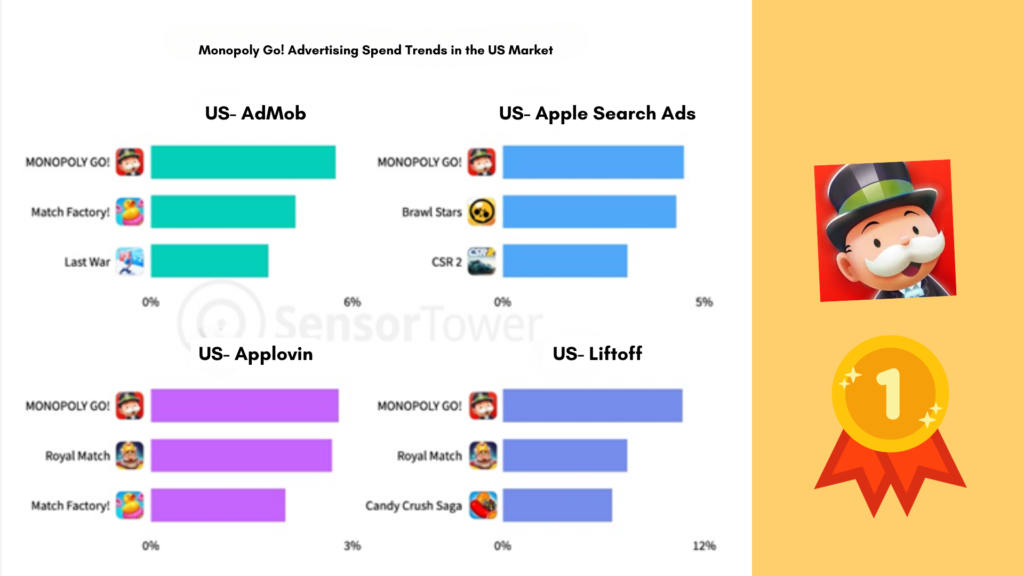

US Gaming Market Insights

In the US mobile game market, puzzle game ads have a significant share of voice (SOV) on platforms like AdMob, AppLovin, Mintegral, and Unity, reaching 34%, 40%, 37%, and 37%, respectively. ‘Royal Match’ and ‘Match Factory!’ are the top puzzle game advertisers.

Ads for popular titles like ‘MONOPOLY GO!’ are fairly evenly distributed across different platforms, with SOV on AdMob, Apple Search Ads, AppLovin, Unity, and Facebook all around 15%.

On YouTube, the SOV for RPG and strategy games is 26% and 43%, respectively. Strategy game ads also tend to be placed on TikTok and Meta platforms.

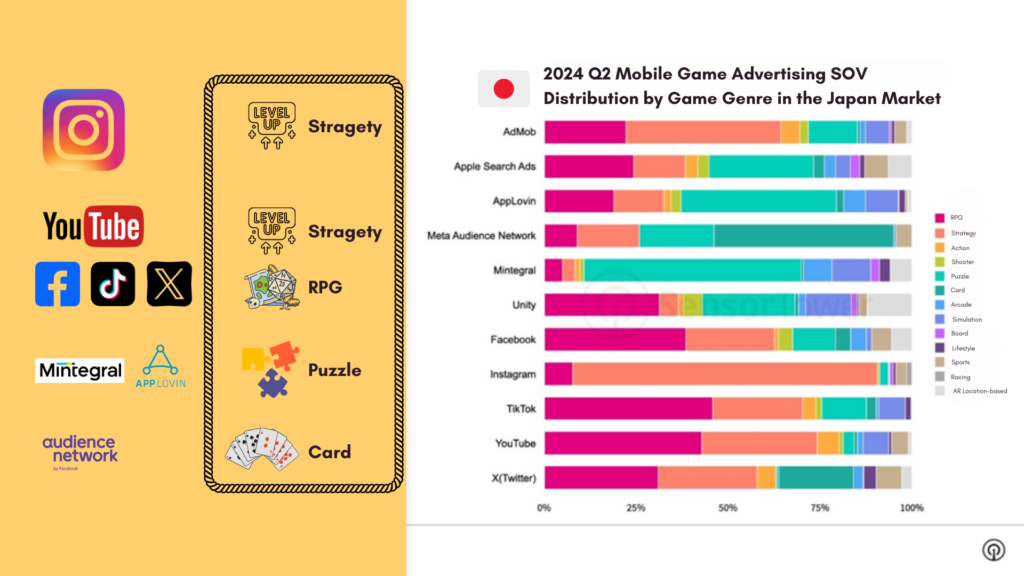

Japanese Gaming Market Insights

X, YouTube, TikTok, and Meta Platforms Dominate SOV for RPG and Strategy Games

In the Japanese mobile game market, RPG and strategy games such as ‘Last War’ and ‘ Honkai: Star Rail ‘ have a significant share of voice (SOV) on popular advertising platforms like X (Twitter), YouTube, TikTok, Facebook, and Instagram, especially compared to casual games.

On Instagram, strategy games like ‘Whiteout Survival’ have an impressive SOV of 83%, while RPG games like ‘ Legend of Mushroom ‘ have a SOV of 43% on TikTok and YouTube.

Puzzle games in the Japanese market prefer advertising on AppLovin and Mintegral platforms, while Meta Audience Network stands out for card game ads’ SOV compared to other platforms.

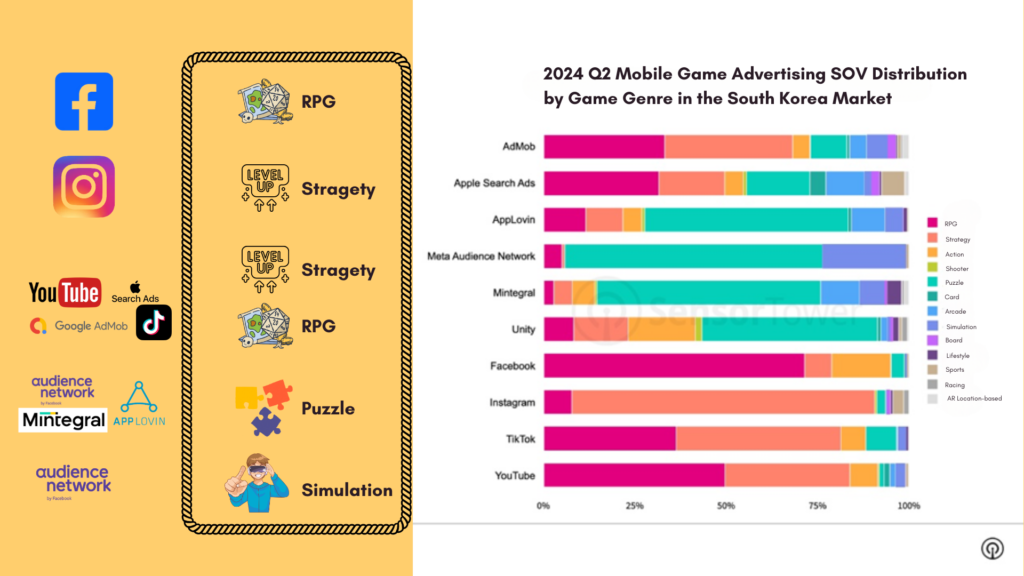

South Korean Gaming Market Insights

n the South Korean mobile game market, ads for RPG and strategy games are widely distributed across platforms like Facebook, Instagram, AdMob, TikTok, and YouTube. On Facebook, RPG game ads like ‘Raven 2’ have a SOV of 72%, while strategy game ads on Instagram, like ‘Squad Busters’, reach a SOV of 80%.

Puzzle games in South Korea heavily favour AppLovin, Mintegral, and Meta Audience Network for advertising. On these three platforms, the SOV for puzzle games is 56%, 71%, and 61%, respectively.

US Market Mobile Game Ads Exceed $650 Million in H1 2024

In the first half of 2024, mobile game publishers in the US market spent over $650 million on digital ads across popular platforms like Facebook, Instagram, YouTube, and TikTok. Strategy and RPG mobile game ads accounted for 35% and 28% of this expenditure, respectively.

During this period, in-app revenue from strategy games in the US market reached $2 billion, with an ad ROI of 9.3. RPG mobile games generated nearly $1.2 billion in revenue, with an ad ROI exceeding 7.

YouTube is the main channel for strategy and RPG midcore game ads in the US market. In the first half of 2024, over 60% of ad spend for these games was on YouTube.

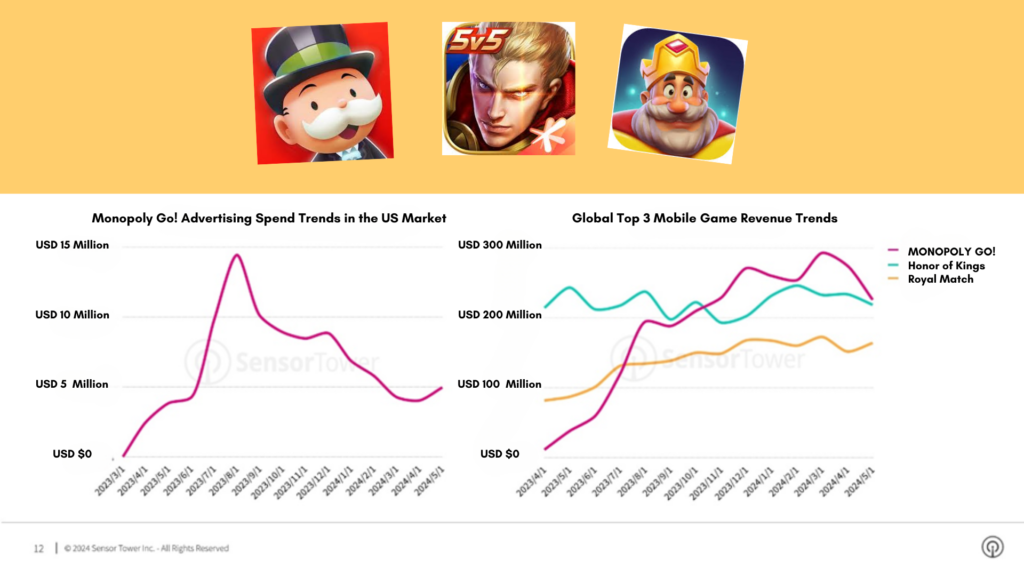

‘MONOPOLY GO!’ Generates Over $2.8 Billion Globally, Achieves 22 ROI in US Market

In April 2023, Scopely launched the mobile board game ‘MONOPOLY GO!’, based on the classic Monopoly IP. Through a combination of extending and innovating on the traditional Monopoly gameplay and extensive advertising, ‘MONOPOLY GO!’ saw its in-app revenue grow consistently, reaching over $200 million in monthly revenue by October 2023 and securing the top spot in global mobile game revenue rankings.

According to Sensor Tower data, as of June 2024, ‘MONOPOLY GO!’ had spent a total of $100 million on digital ads in the US market, with cumulative in-app revenue reaching $2.2 billion, resulting in an impressive ad ROI of 22.

In the second quarter of 2024, ‘MONOPOLY GO!’ continued to dominate ad SOV across platforms like AdMob, Apple Search Ads, AppLovin, and Liftoff in the US market.

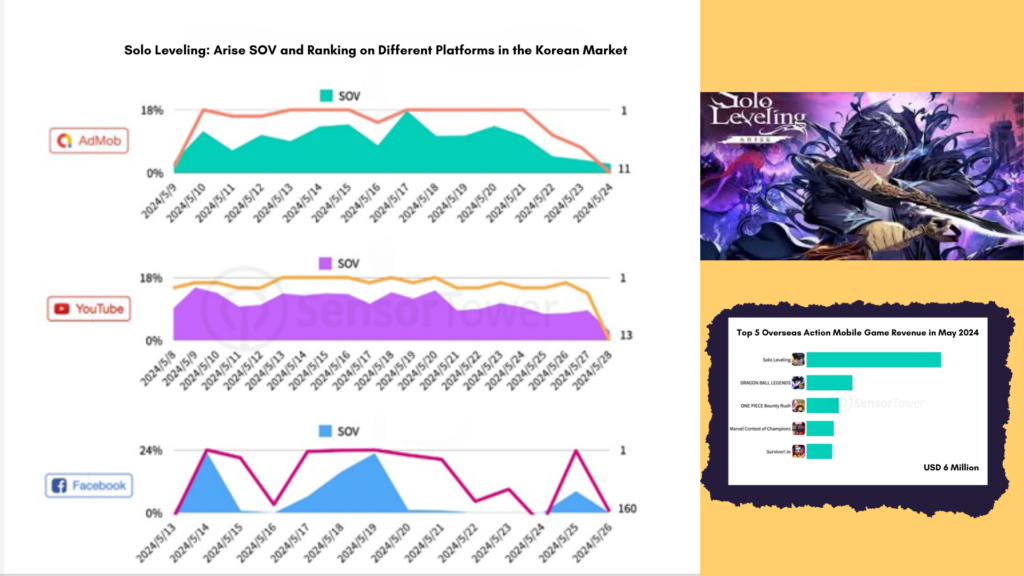

‘Solo Leveling: Arise’ Tops SOV Rankings Across Multiple Platforms in South Korea

On May 8th, Netmarble launched the anime-style action mobile game ‘Solo Leveling: Arise’ globally. The game’s IP is based on the original South Korean novel ‘Solo Leveling’, and its webtoon adaptation has garnered over 14.3 billion views worldwide.

According to a report by Sensor Tower, from early to late May, ‘Solo Leveling: Arise’ consistently ranked high on the SOV charts across multiple platforms in South Korea, including AdMob, YouTube, and Facebook. In Japan and the US, ‘Solo Leveling: Arise’ also executed significant ad campaigns, securing the second spot on YouTube’s SOV rankings in Japan in May.

‘Solo Leveling: Arise’ has surpassed USD 80 million in global revenue, leading the overseas action game market. Leveraging the global impact of the ‘Solo Leveling’ IP and targeted advertising, ‘Solo Leveling: Arise’ quickly topped the iOS and Android download charts in major markets, including the US, Japan, South Korea, the UK, France, India, and Indonesia. By June 23, 2024, the global revenue of ‘Solo Leveling: Arise’ had exceeded USD 80 million.

SOV Rankings for ‘Solo Leveling: Arise’ on Different Platforms in the South Korean Market:

AdMob: Maintained a high SOV, fluctuating around 18%, consistently ranking in the top 1-2 positions.

YouTube: Achieved similar SOV levels around 18%, with a top ranking position.

Facebook: Saw higher fluctuations in SOV, peaking at 24%, while maintaining top positions in the rankings.

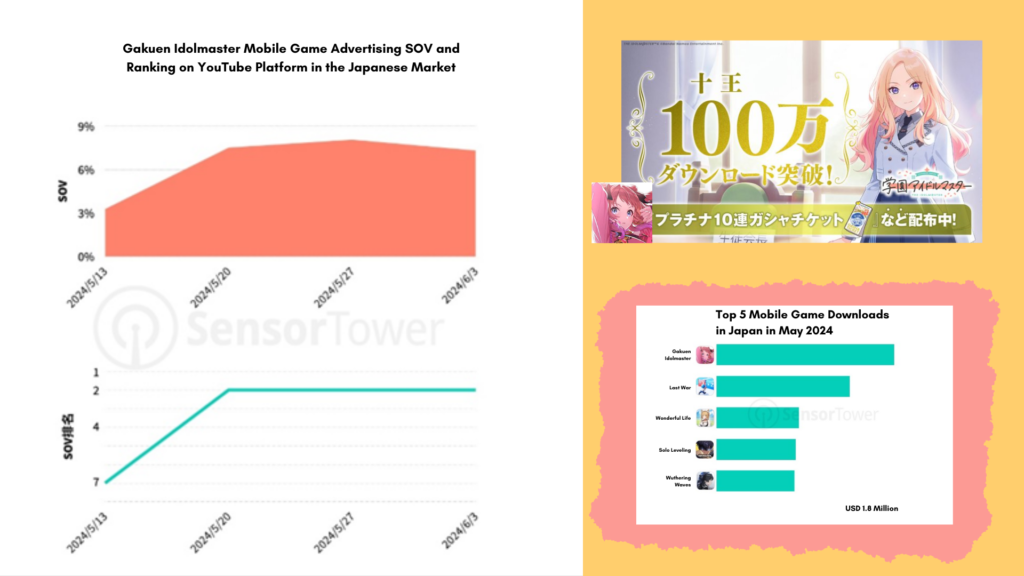

‘Gakuen Idolmaster’ Climbs to Top Ranks in Japan’s YouTube Mobile Game Ad SOV

In mid-May 2024, Bandai Namco Entertainment launched a new school idol simulation game, ‘Gakuen Idolmaster,’ in the Japanese market. Based on the idol IP “The Idolmaster,” the game features beautifully crafted characters and audiovisual effects. Since its release, the advertising share of voice (SOV) for ‘Gakuen Idolmaster’ has steadily increased, consistently ranking second on the YouTube mobile game ad SOV charts in Japan for several weeks and becoming the highest SOV simulation game on YouTube in May.

The advertising materials for ‘Gakuen Idolmaster’ mainly feature banner ads, highlighting exquisite 2D art styles and adorable idol IP characters. The fresh school-themed content has been particularly appealing to young players, earning the game a 91% five-star rating on the App Store.

Leveraging the IP’s distinct features and efficient advertising, ‘Gakuen Idolmaster’ topped the Japanese iOS and Android app download charts on its first day of release. Within two weeks, the game surpassed 1.6 million downloads, overtaking ‘Last War: Survival Game’ to become the most downloaded mobile game in Japan in May. This surge boosted Bandai Namco Entertainment’s download and revenue growth in the Japanese mobile game market by 395% and 85%, respectively, earning them the top spots on both the download and revenue charts for mobile game publishers in May.

Japan Market Download Rankings

The graph shows the download rankings for ‘Gakuen Idolmaster’ on iPhone, iPad, and Android platforms from May 8 to May 23, 2024.

Top 5 Mobile Games by Downloads in Japan for May 2024:

- Gakuen Idolmaster

- Last War

- Wonderful Life in Another World

- Solo Leveling

- Wuthering Waves

‘Gakuen Idolmaster’ leads the chart, significantly surpassing other popular games in download numbers.

Please reach out to Gloria at [email protected] for more details.

Source from: Sensor Tower